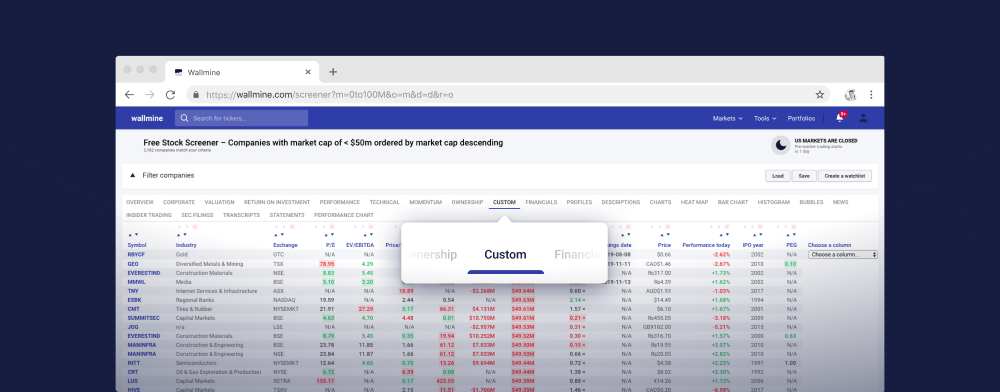

Darmowy Stock Screener

Load Zapisać Utwórz listę obserwacyjną Help| Symbol | Firma | Giełda | Przemysł | Kapitalizacja rynkowa | EBITDA | P/E | EV/EBITDA | Dług / kapitał własny | Średnia objętość | Własność instytucjonalna | Data zarobków | Cena | Wydajność dzisiejsza |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0HD6 | Alphabet Inc. | LSE | n/a | $859.66B | $96.887B | 18.29 | N/A | 0.43 | 135.510k | 66.22% | N/A | $114.939 | +0.44% |

| 0KZC | SPDR S&P 500 ETF Trust | LSE | n/a | $361.70B | N/A | 5.80 | N/A | 0.00 | 92.990k | 67.87% | N/A | $555.577 | +0.95% |

| 0TDD | Novo Nordisk A/S | LSE | n/a | $305.33B | kr72.022B | 40.37 | N/A | 1.75 | 26.299k | 8.30% | N/A | $135.45 | -0.07% |

| 0TDF | Roche Holding AG | LSE | n/a | $278.72B | CHF23.955B | 16.68 | N/A | 2.61 | 11.649k | 1.27% | N/A | $37.79 | -7.99% |

| 0HN3 | BHP Group | LSE | n/a | $240.04B | $37.648B | 19.06 | N/A | 1.03 | 7.643k | 4.13% | N/A | $52.4088 | +2.37% |

| 0YXG | Broadcom Inc. | LSE | n/a | $220.93B | $18.163B | 6.33 | N/A | 2.03 | 53.916k | 83.20% | N/A | $158.70 | +2.17% |

| 0R0H | Thermo Fisher Scientific Inc. | LSE | n/a | $216.12B | $12.354B | 34.66 | N/A | 1.33 | 10.592k | 90.99% | N/A | $613.44 | -1.36% |

| 0K9E | Novartis AG | LSE | n/a | $207.30B | $16.100B | 12.77 | N/A | 0.95 | 10.649k | 9.65% | N/A | $115.36 | -1.16% |

| 0I47 | Costco Wholesale Corporation | LSE | n/a | $203.32B | $9.693B | 62.31 | N/A | 2.11 | 4.483k | 69.23% | N/A | $900.62 | +0.72% |

| TM5 | T Mobile Us Inc.Dl, 00001 | XETRA | n/a | $172.09B | N/A | 18.20 | 13.94 | 2.21 | 357.000 | N/A | N/A | €178.02 | +0.00% |

| 0JVQ | Lowe's Companies, Inc. | LSE | n/a | $160.27B | $14.313B | 23.36 | N/A | -10.27 | 19.544k | 79.44% | N/A | $246.10 | -0.62% |

| 0R2H | Texas Instruments Incorporated | LSE | n/a | $159.23B | $11.621B | 21.18 | N/A | 0.85 | 35.256k | 87.84% | N/A | $199.97 | +0.37% |

| 0R08 | United Parcel Service, Inc. | LSE | n/a | $153.24B | $16.862B | 9.75 | N/A | 3.87 | 8.896k | 71.43% | N/A | $127.87 | -0.95% |

| 5UR | Raytheon Tech. Corp. ,01 | XETRA | n/a | $144.44B | N/A | 63.85 | 15.71 | 1.63 | 762.000 | N/A | N/A | €108.22 | +0.77% |

| TBB | AT&T, Inc. | NYSE | n/a | $139.80B | $43.133B | 0.00 | 5.42 | 4.01 | N/A | N/A | N/A | $24.49 | +0.04% |

| 0R3E | Lockheed Martin Corporation | LSE | n/a | $133.30B | $8.623B | 27.02 | N/A | 3.64 | 2.143k | 76.26% | N/A | $563.01 | -1.33% |

| 0HG8 | Anthem, Inc. | LSE | n/a | $127.41B | $10.143B | 22.91 | N/A | 1.70 | 863.000 | 94.06% | N/A | $540.91 | -0.37% |

| 0QZA | ConocoPhillips | LSE | n/a | $125.85B | $30.218B | N/A | N/A | 1.00 | 9.574k | 81.82% | N/A | $102.7691 | -0.52% |

| A58 | Anthem Inc. Dl ,01 | XETRA | n/a | $121.61B | N/A | 18.17 | N/A | 1.76 | 13.000 | N/A | N/A | €430.00 | -0.92% |

| TD.PF.I | The Toronto-Dominion Bank | TSX | n/a | $120.32B | N/A | 9.54 | N/A | 17.07 | 14.830k | 20.42% | N/A | CAD$25.90 | +0.04% |

| TD.PF.F | The Toronto-Dominion Bank | TSX | n/a | $114.19B | N/A | 5.03 | N/A | 16.21 | 399.000 | 9.18% | N/A | CAD$25.98 | -0.04% |

| 0QZZ | BlackRock, Inc. | LSE | n/a | $108.59B | $7.407B | 24.75 | N/A | 3.02 | 1.890k | 80.28% | N/A | $870.54 | -1.24% |

| 0HJI | Automatic Data Processing, Inc. | LSE | n/a | $107.55B | $4.504B | 44.43 | N/A | 18.55 | 12.796k | 81.52% | N/A | $275.8701 | -0.72% |

| TD.PF.B | The Toronto-Dominion Bank | TSX | n/a | $107.45B | N/A | 11.96 | N/A | 17.07 | 88.746k | 34.80% | N/A | CAD$25.00 | +0.00% |

| 0L3I | The Charles Schwab Corporation | LSE | n/a | $106.49B | N/A | 13.27 | N/A | 13.19 | 75.918k | 84.51% | N/A | $62.8595 | +0.18% |

| TD.PF.H | The Toronto-Dominion Bank | TSX | n/a | $106.42B | N/A | 9.40 | N/A | 17.30 | 28.850k | 12.55% | N/A | CAD$24.99 | +0.00% |

| TD.PF.K | The Toronto-Dominion Bank | TSX | n/a | $106.09B | N/A | 10.11 | N/A | 17.07 | 2.041k | 24.15% | N/A | CAD$24.965 | -0.10% |

| TD.PF.M | The Toronto-Dominion Bank | TSX | n/a | $105.85B | N/A | 8.39 | N/A | 17.07 | 46.942k | 22.17% | N/A | CAD$25.00 | +0.00% |

| TD.PF.G | The Toronto-Dominion Bank | TSX | n/a | $105.19B | N/A | 9.29 | N/A | 17.30 | 3.632k | 7.81% | N/A | CAD$25.00 | +0.04% |

| TD.PF.D | The Toronto-Dominion Bank | TSX | n/a | $103.60B | N/A | 10.29 | N/A | 17.07 | 13.840k | 53.94% | N/A | CAD$23.94 | +0.59% |

| A0T | American Tower Dl ,01 | XETRA | n/a | $102.65B | N/A | 41.23 | 23.69 | 5.08 | 10.000 | N/A | N/A | €9.91 | +0.00% |

| TD.PF.L | The Toronto-Dominion Bank | TSX | n/a | $102.62B | N/A | 8.17 | N/A | 17.07 | 904.000 | 13.64% | N/A | CAD$24.99 | -0.04% |

| 0R0G | Mondelez International, Inc. | LSE | n/a | $96.26B | $6.019B | 34.84 | N/A | 1.37 | 13.607k | 80.03% | N/A | $73.96 | -1.83% |

| ENB.PF.V | Enbridge Inc. | TSX | n/a | $96.16B | CAD$11.712B | 24.14 | N/A | 1.99 | 4.420k | 2.86% | N/A | $22.82 | -0.57% |

| 0L95 | Square, Inc. | LSE | n/a | $95.76B | -$159.26 | N/A | N/A | 3.24 | 17.595k | 65.44% | N/A | $73.8079 | +0.15% |

| 0LCE | The TJX Companies, Inc. | LSE | n/a | $94.10B | $5.483B | 43.85 | N/A | 3.74 | 44.142k | 93.89% | N/A | $117.6095 | -0.11% |

| KTF | Mondelez Intl Inc. A | XETRA | n/a | $90.74B | N/A | 30.06 | 21.19 | N/A | 618.000 | N/A | N/A | €67.28 | +0.28% |

| 0R1F | Bristol-Myers Squibb Company | LSE | n/a | $89.50B | $20.383B | 9.32 | N/A | 2.04 | 55.553k | 78.94% | N/A | $72.70 | +0.28% |

| 0K92 | Northrop Grumman Corporation | LSE | n/a | $88.09B | $8.757B | 18.77 | N/A | 2.29 | 348.000 | 84.57% | N/A | $509.83 | -1.92% |

| GCP | General Electric Co | XETRA | n/a | $86.49B | N/A | 18.58 | 106.94 | 4.70 | 2.076k | N/A | N/A | €150.50 | +1.35% |

| 0KYY | S&P Global Inc. | LSE | n/a | $85.38B | $4.720B | 50.49 | N/A | 4.67 | 2.876k | 91.58% | N/A | $512.89 | -1.03% |

| D2MN | Duke En.Corp. Dl ,001 | XETRA | n/a | $85.01B | N/A | 21.98 | 12.63 | N/A | 0.000 | N/A | N/A | €106.36 | -1.04% |

| 0R3C | American Express Company | LSE | n/a | $84.80B | N/A | 19.47 | N/A | 7.50 | 19.796k | 86.75% | N/A | $148.80 | +0.42% |

| 0KWZ | Rio Tinto Group | LSE | n/a | $82.77B | $28.077B | 10.13 | N/A | 0.90 | 12.906k | 10.57% | N/A | $60.745 | +1.95% |

| 0J1R | HCA Healthcare, Inc. | LSE | n/a | $82.32B | $11.973B | 23.98 | N/A | -52.79 | 46.644k | 68.55% | N/A | $387.35 | -0.10% |

| MSN | Marsh & McLennan Companies, Inc. | XETRA | n/a | $82.30B | N/A | 25.76 | 16.53 | N/A | 5.000 | N/A | N/A | €165.20 | -0.48% |

| 4S0 | Servicenow Inc. Dl ,001 | XETRA | n/a | $82.11B | N/A | 71.65 | 109.56 | 1.28 | 181.000 | N/A | N/A | €798.90 | +3.49% |

| PNP | The PNC Financial Services Group, Inc. | XETRA | n/a | $81.39B | N/A | 13.02 | N/A | N/A | 61.000 | N/A | N/A | $163.00 | +0.00% |

| 0IVW | Glencore plc | LSE | n/a | $79.56B | $26.654B | N/A | N/A | 2.27 | 640.000 | 0.05% | N/A | $9.44 | -0.74% |

| 0QZU | Vertex Pharmaceuticals Incorporated | LSE | n/a | $79.27B | $3.277B | 44.80 | N/A | 0.33 | 1.555k | 94.48% | N/A | $469.96 | -0.44% |