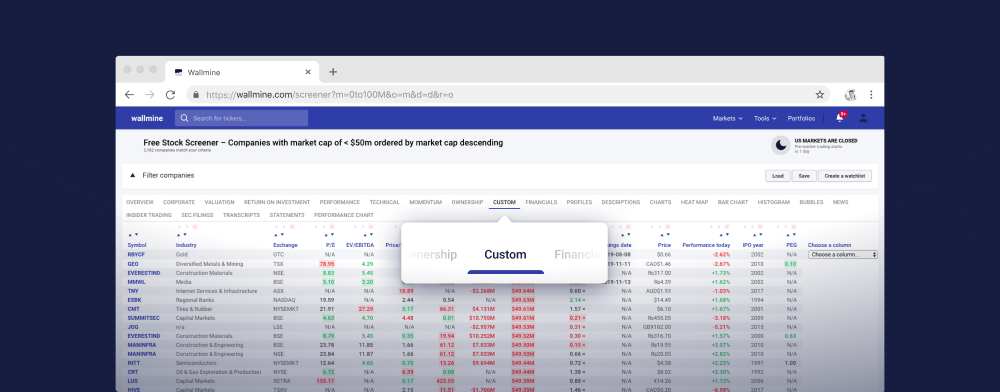

Darmowy Stock Screener

Load Zapisać Utwórz listę obserwacyjną Help

OCSMD

Astra Energy Inc. provides scallop farming and marine hatchery services. It involves in farming, processing, and marketing marine species, such as scallops and sablefish in the west coast of North America. The company's product includes ÂQualicum Beach Scallop', which is a hybrid of the imported Japanese scallop and the local weathervane scallop. It also produces various shellfish seed species, including the Pacific oyster, eastern blue mussel, Mediterranean mussel, and geoduck clam that are sold to third party shellfish farmers. In addition, the company provides consulting, research and development, and custom processing and marketing services, as well as offers aquaculture equipment. The company was founded in 1989 and is based in North Las Vegas, Nevada

- Astra Energy Inc., 3609 hammerop Drive, North Las Vegas 89084, United States

- Investor relations

XIB.P

XIB I Capital Corp. intends to identify and evaluate businesses or assets with a view to completing a qualifying transaction. The company was incorporated in 2018 and is headquartered in Vancouver, Canada.

- XIB I Capital Corp., 550 Burrard Street, Vancouver V6C 0A3, Canada

- 604 833 2387

- Investor relations

Gresham House Strategic plc specializes in PIPE, pre-IPO, growth and acquisition, recovery capital investments. The fund invests in financial services, media, information and communication technology, digital information and technology, healthcare, and life sciences. It prefers to invest in companies based in United Kingdom and Europe and can also co-invest outside Europe with local venture capital firms. The fund also seeks to make follow on investments. It invests in companies with market capitalizations of less than £250 million ($283.87 million) and seeks to acquire stakes between 5% and 25% for cash or share consideration. It seeks to invest between three to five years. The fund invests in smaller public companies as well as private companies. It invests in public companies that are listed on FTSE All-share and AIM All-Share Index; stocks trading greater than 50% below 3 year price high; EV or EBITDA less than 7 times, gearing more than 75%, ROCE greater than 10%, FCF Yield greater than 10%. The fund invests in private companies in P2P opportunities, equity and equity-related instruments, preferred equity, preferred quasi equity positions including convertible and non-convertible debt instruments, and mezzanine preferred instruments. It attracts portfolio in scenarios - excluding cash, portfolio trades on a weighted average EV or EBITDA greater than 5 times; generating in excess of 10% growth in 2017 based on broker forecasts. The fund targets 15% net IRR over the long-term.

- Gresham House Strategic Plc, 5 New Street Square, London EC4A 3TW, United Kingdom

- ghsplc.com

- Investor relations

l3harris technologies is an agile global aerospace and defense technology innovator, delivering end-to-end solutions that meet customers’ mission-critical needs. the company provides advanced defense and commercial technologies across space, air, land, sea and cyber domains. l3harris has approximately $18 billion in annual revenue and 47,000 employees, with customers in more than 100 countries. l3harris.com.

- L3Harris Technologies Inc, 1025 West NASA Boulevard, Melbourne 32919, United States

- 321 727 9100

- l3harris.com/

- Investor relations

Yi Hua Holdings Limited, an investment holding company, operates department stores under the Yihua Department Store brand in the People's Republic of China. It operates through eight segments: Department Store, Supermarket and Convenience Store, Electrical Appliances, Furniture, Consulting Service, Property Investment, Property development, and Others. The Department Store segment offers watches, jewelries, cosmetics, handbags, leather goods, children's products, clothing, shoes, textiles, sportswear, beddings, etc. The Supermarket and Convenience Store segment offers food and beverages, perishables, and other household products under the Yihua Lejia Supermarket brand. The Electrical Appliances segment provides electrical appliances, such as refrigerators, washing machines, air conditioners, televisions, kitchen appliances, rice cookers, hair dryers, toasters, etc. under the Yihua Sihai Electrical Appliance Centre brand. The Furniture segment operates furniture stores under the Yihua Shijia brand. The Consulting Service segment engages in the market research activities, as well as provides advice on design, decoration, and layout for properties. The Property Investment segment develops and leases commercial properties. The Property Development segment develops and sells residential properties, carparks, and commercial properties. The Others segment engages in the production and sale of game console; educational software development; and virtual reality business. The company also engages in the e-commerce business; and the operation of vegetables and fruits stores. Yi Hua Holdings Limited was formerly known as Yi Hua Department Store Holdings Limited and changed its name to Yi Hua Holdings Limited in October 2015. The company was founded in 1994 and is headquartered in Zhongshan, the People's Republic of China.

AAWCD

Tian Poh Resources Limited, together with its subsidiaries, engages in the exploration of mineral properties in Mongolia. It focuses on the exploration of coal, copper, and gold deposits. The company owns a 100% interest in two mining concessions, including the Nuurst thermal coal project located to the south east of Ulaanbaatar. It also has nine exploration licenses located in the mineral provinces of Southern Mongolia. The company's concessions are grouped in five project areas covering an area of approximately 125,000 hectares. Tian Poh Resources Limited was incorporated in 2014 and is based in Singapore.

- Tian Poh Resources Limited, 48 Pandan Road, Singapore 609289, Singapore

- 65 6898 0009

- tianpoh.com

- Investor relations